How Challenging Times Impact Consumer Behavior

How are you doing? We’re hanging in there, staying positive, and working in new ways. As our inboxes and feeds are flooded with COVID-19 news and forecasts, we wanted to find a helpful way to connect during this unprecedented time. One area that we’ve been closely observing is consumer behavior. Being a business-to-consumer advertising agency means that consumer behavior is critical to our development of brand strategies, marketing, and all forms of outreach.

Challenging times like these make us painfully aware of the degree to which consumer confidence drives spending, which is an essential component to the U.S. and global economy. In 2019, consumer spending was 70% of the U.S. gross domestic product. We decided to share some research and resources we’ve discovered while looking into how consumer behavior is changing and may change over time.

Like all agencies, we are trying to make sense of this new normal, and we’re noticing that rapid change affects marketers and consumer behavior in two ways. There is “what we react to,” and there is “what we realize.” What we react to refers to how companies quickly shift to make immediate, short-term adjustments to match consumer needs. What we realize is in regards to the long-term adjustments that need to be built over time.

Marketing is all about plans. One thing challenging times teach us is that world events have no regard for plans and can even disrupt all aspects of modern life. These types of events can be thought of as “Black Swan” events. Nassim Nicholas Taleb popularized this term in his book The Black Swan.

“What we call a Black Swan is an event with the following three attributes. First, it is an outlier, as it lies outside the realm of regular expectations because nothing in the past can convincingly point to its possibility. Second, it carries an extreme ‘impact.’ Third, in spite of its outlier status, human nature makes us concoct explanations for its occurrence after the fact, making it explainable and predictable.”

–The Black Swan, 2007

How we’ll look back and try to explain the events of 2020 is anyone’s guess. One thing is for sure: we are all experiencing a Black Swan event, at more or less the same time, regardless of where we live. It’s rare that something so outside of our regular expectations can upset the world to such a degree in such a short amount of time.

So, how does this affect consumer behavior? What should marketers plan for? What should marketers do? What’s the role and tone of advertising, promotion, and consumer relationships? Each industry will have its unique issues and strategic nuances as they address these questions.

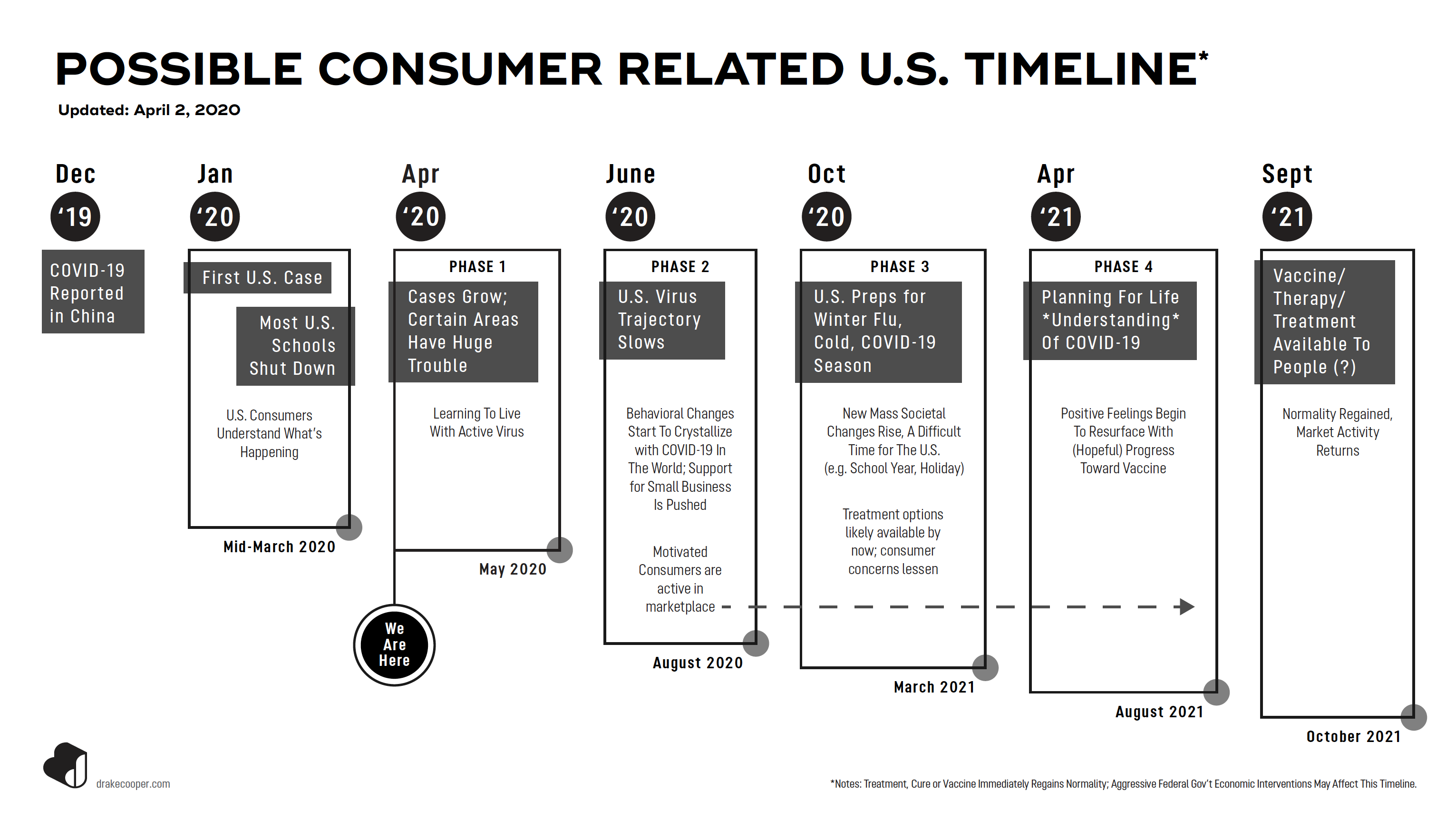

Our goal is to outline some starting points for contemplation and a framework that can be applied, regardless of industry. The first of such starting points is time. Of course, COVID-19 is a rapidly changing situation. It’s also highly dependent on two things — positive things — that could strike at any time: how we find treatments, a vaccine, and a cure, and how the government intervenes to help support the marketplace, consumer spending, and economic bolstering.

With the brightest minds across the world working on the same issue, we’ve outlined a worst-case scenario that could extend 18 months in the U.S. in some form but could also resolve much sooner. Within this horizon, we see several phases, each requiring marketers to plan differently. While events evolve, we’ll be updating our time horizon and what each one means.

As consumers journey across these phases, many changes in behavior will happen. How do we make sense of them to create functional, actionable plans? It’s important to note that across all industries, there will be active consumers who need and want things.

We believe Black Swan events create two dynamics: What we react to and what we realize. These are different things, and they should require various analyses and applications by marketers. They also provide a helpful framework from which to organize around.

WHAT WE REACT TO:

Black Swan events cause immediate mass changes in consumer behavior. These are the things that we quickly react to and reflect the immediate short-term adjustments companies and organizations need to make to match consumer needs. Addressing these changes should happen within weeks. These adjustments remain important and viable for the foreseeable future as the nature of the event is handled and evolves across society. Often, adjustments made here will minimize or even fall off after the event has run its course.

Examples for C-19 are showing themselves now in areas such as consumers wanting to find the lowest prices and save every dollar they can (similar yet perhaps more extreme to what they did in 2007), tending to their home since they are spending so much time there, and any theme around safety and protection. We have listed the key areas that consumers will REACT TO below as a way to help marketers develop quick solutions, rapidly match consumer needs, and continue to protect (and perhaps in some cases even grow) the market share they have now.

WHAT WE REALIZE:

Beyond immediate adjustments, every Black Swan event makes us realize more important things that we weren’t doing, but should have. What we realize during times like these are the long-term adjustments companies need to build to. These adjustments will remain part of our culture for a long time. After 9/11, these examples included pride and support for our military and first responders (which we realized we didn’t do nearly enough of before) and a world of heightened security (which we realized we were too relaxed about before, especially at airports).

For C-19, the long-term themes companies should consider are still forming. However, some are becoming quickly clear. Such realizations will be our mass acceptance of the ability for people to connect with people from anywhere and how America needs to increase our level of cleanliness throughout our society.

Following is our evolving list of trends that fall into both categories:

I. WHAT WE REACT TO TRENDS:

1. Lowest Price Wins: Masses prioritize the most economical price offering in most categories.

2. Deal Hunting: Securely employed consumers seek out low prices and significant deals.

3. Hoarding + Storing: Resources, products, and design to support more items.

4. Homelife Grows: People maximizing or repurposing home spaces (for working, exercising, teaching, etc.)

5. Preferred Self Sufficiency + Security: Preference to support more secure or “Do It Yourself” lifestyles.

6. Ecommerce Expansion (+↑DTC): People expand beyond norms, increasing a variety of online activities.

7. Reactive + Unrefined Content: Brands will create content with fewer people involved, and consumers will see even more ‘unpolished’ digital content.

8. Timely Sentiments + Authenticity: With global-to-local news fluctuating heavily every day, brand messages must be highly attuned to current consumer sentiment. Authenticity in communication should manifest in the form of public service from each brand (via consumer availability and access).

9. Prioritized Health + Wellness: Increasing interest in offerings to support preventative healthcare and maintaining wellness, in addition to more innovative ideas for improved self-care.

10. General Anxiety + Neuroticism: Social distancing creates anxiety; people learn to cope with employment and relationship shifts from a distance.

II. WHAT WE REALIZE TRENDS:

1. Expanded Online Possibility: Connecting from anywhere becomes commonly accepted. Tools and social acceptance evolves to embrace a world where a true connection can happen without being in physical proximity.

2. Enhanced Bandwidth: Increased demand for faster connections and more bandwidth as digital/personal channels become more popular (V.R., etc.).

3. Cleanliness As A Value: Americans prioritize people, spaces, and things that provide more sanitary environments.

4. The Importance of Community: People become more attuned to looking around and noticing their immediate communities and how to support/interact with each other.

5. An Aversion Away From A Highly Partisan World: People may find more unity, and a lesser degree of political vitriol may happen. Americans may unify around what were previously traditionally divisive political ideas (access to/universal healthcare, UBI, etc.).

6. Access, Capability, And Capacity Of The Healthcare System: Healthcare rises and is seen as even more noble work than before. People begin asking better questions about how the system needs to work and how it can better help Americans.

7. Collectivism Versus Individualism: How the adoption of positive individual behavior changes can be managed in a free society. Could impact how other issues are addressed, such as climate change.

III. THE EVOLVING MEDIA ENVIRONMENT

During Black Swan events, our time spent with the media rises. This is the case today with C-19 news and information driving one-third of all page views. Over the next 18 months, the way people engage with the media will shift. Some mediums will experience a rise and some will fall. Within those experiencing an increase, the tone and manner of who brands promote themselves will require extreme care.

Mediums that are impacted based on how consumers are reacting right now:

- Increasing consumption of broadcast TV, connected TV, online video, social media, streaming audio, and digital display. Within those experiencing a rise, the tone and manner of brands that promote themselves will require extreme care.

- Decreasing consumption of out-of-home, print, and broadcast radio (in cars but likely not streaming equivalents).

As we realize the new media landscape in the long-term, contextual targeting will become increasingly important.

- Increased medium consumption does not translate to simply reallocating money. Much of what goes into traditional media buying (intentional TV programming choices, placement of outdoor boards, which section of the newspaper we want to run in) will be paramount for digital.

- Advertisers have gotten away with letting digital algorithms do their magic. We love targeting the right person at the right time with the right message. We need to start layering in more controls and investment into appearing in the right places — beyond a simple medium choice. The upcoming death of third-party cookies on Google Chrome already jolted the media industry, and without a widely agreed upon alternative, buying site direct instead of programmatic sounds much more viable.

- Certain social platforms, like Pinterest, are somewhat insulated from the COVID-19 reaction we see on Facebook and Reddit newsfeeds. That kind of nuanced understanding of social media channels is increasingly important.

- Paid search will continue as a strong medium to pull consumers toward your brand because they are actively seeking you or something like you.

IV. RESOURCES

During this time of C-19, what consumers react to and what they realize is a continuously evolving collection of things. Below are the key resources that our agency is keeping up with to best monitor the situation.

Gallup: Public opinion across America on C-19.

Nielsen: Tracking the ongoing impact of C-19 across media, retail, and consumer packaged goods.

WARC Snapshot: A special Snapshot series offering guidance and insights to marketers amidst the ongoing novel coronavirus (COVID-19) outbreak. Series includes resources for the following: Consumer Behavior, COVID-19 Strategy, Media Plans, and Adspend, Adapting Creative Comms. (Note: Paywall which Drake Cooper subscribes to.)

Bain & Co. Situational Threat Report: The Situational Threat Report Index from Bain’s Macro Trends Group combines official data with their own modeling to evaluate the COVID-19 outbreak’s effect on global business.

McKinsey Executive Briefing: Tracking U.S. consumer sentiment. Implications for business, intended to provide business leaders with a perspective on the evolving situation and implications for their companies. Outbreak Scenarios and Response Actions: Workforce protection, Supply-chain stabilization, Customer engagement. Complete Report PDF.

Ipsos C-19 U.S. Sentiment: Ongoing research tracking of the overall global impact of C-19 across people, societies, and markets.

AdAge CMO Strategy Report: The latest moves big brands are making to deal with the fallout, in reverse chronological order.

Deloitte COVID-19 Resilience: This page brings together Global Deloitte insights to help businesses manage and mitigate the risk.

Ads Of The World C-19 Portfolio: Ongoing curation of ads from around the world that feature C-19.

Authors:

John Drake, Chief Strategy Officer

Jamie Cooper, CEO, President

Sean Young, Story Director

Molly Brunett, Account Planner

Maria Walker, Director of Data & Communication Strategy

Shock And Pause: Mass Media Consumption During a Pandemic

With most retailers going silent with their usual flash sales and deals, this might be the moment to be seen and heard in a new light.

Our Creative Advertising Services

-

Corporate Positioning, Brand Evolution & Strategy

Mission/Vision Development, Strategic Counsel For Marketing/Branding Challenges

-

Market Research

Quantitative, Qualitative, Ethnography, Consumer and/or Internal Stakeholder Insights

-

Creative Campaigns

Brand Campaigns, Product Launches, Full Funnel Marketing Efforts

-

Brand Design

Brand Guides, Style Guides, Branding Elements, Logos

-

Web Development and Digital Applications

Open-Source Platforms, Enterprise WordPress, eCommerce, AR, Emerging Technology

-

Media Strategy, Planning & Buying

Media Planning, Media Plan Development, Media Buying, MMM, Online and Offline

-

MarTech

AI, Responsible Consumer Data Management, AdOps, Marketing Software

-

Analytics

Dashboards, Insights, Business Metrics Evaluation, ROI Reporting, Data Warehousing

-

Content Creation

Videography, Photography, Short-Form Video, Organic Social Content

-

Findability™

SEM, SEO, GEO (AI Generative Experience Optimization), Voice Search