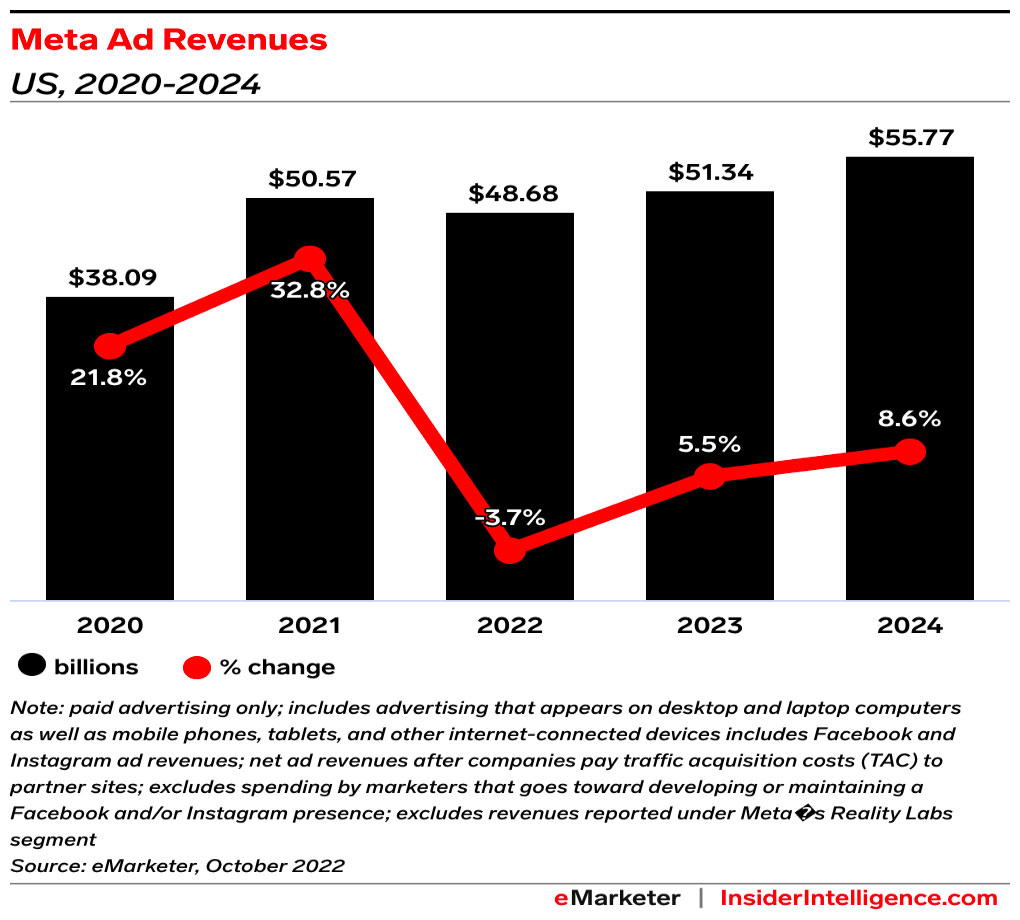

Has Meta become a four-letter word in anyone else’s vocabulary? With constant updates, news-worthy headlines, and countless privacy concerns, when it comes to Facebook and Instagram, Meta is a frequent topic of conversation at Drake Cooper. For nearly ten years both channels have dominated ad spend on media plans, but today our industry is seeing a shift away from them, punctuated by the company’s first-ever decline in ad spend recorded during Q2 of this year. When a channel has been dominant for so long it’s hard not to be concerned by such a drastic shift and it begs the question: What will Facebook and Instagram’s ad platforms look like in the not-too-distant future?

Hopefully: Less Metaverse, More Advertising Solutions

Let’s start with the metaverse. That division (Reality Labs) lost $9 billion during the first three quarters of 2022. (SOURCE) There has been a lot of speculation around the metaverse and where it’s going. Consumer adoption is drastically lower than anticipated. While it may appeal to some larger brands, it’s not currently a space that mid-market advertisers have the budget or resources to tap into. As our economy heads into unprecedented times fewer marketers are willing to take the risk to invest in the unknowns of the metaverse. To win back its share of budget shifting to other digital channels, we hope that Meta prioritizes improving its existing ad solutions across Facebook and Instagram rather than pouring their effort into this new and uncertain space.

The Social Leader Isn’t Leading As It Could

The biggest concern for Meta within the social landscape is the growth across competing channels, like TikTok. Feed usage across Facebook and Instagram has drastically decreased, and more users are navigating the platform through stories or sharing content through direct messages. (SOURCE) Another downfall of Meta’s social platforms is that currently only 15% of a user’s feed is based on an AI algorithm, whereas TikTok is almost solely based on that model. (SOURCE)

Meta at large continues to take up a huge percentage of users within the social landscape. Total monthly active users for Facebook & Instagram combined are 3.71 billion. (SOURCE) Compare that to TikTok’s 1.2 billion active monthly users and it puts things into perspective. So while as advertisers we have frustrations with Meta, their social usage is undeniable. But the company needs help maintaining that level of active users as they face increased competition in-market with other social channels and their technologies.

We are continuously seeing the trend of social channels becoming more similar to one another. While how you engage or communicate on each platform may differ, we all see platforms copying each other’s successful rollouts— TikTok -> Instagram Reels, BeReal -> TikTok Now, Snapchat stories -> Instagram stories.

At Drake Cooper, we are witnessing this shift first-hand and capitalizing on it by incorporating more short-form videos and prioritizing reels and stories over in-feed ads, which is reaping positive benefits. We’ve seen higher engagement rates, improved brand recall, and higher-quality traffic. But the scale on Meta’s social platforms is not what it used to be. If we set up a campaign and do not narrow in on the placements we run on, we naturally see Meta spending 80-90% of the impressions on Facebook versus only 10-20% on Instagram— in some cases, not all. How does Meta’s AI allow spending to skew that heavily toward a platform with minimal growth? (Especially with the emphasis on Reels and Story placements we’ve seen this year on Instagram.)

Facebook and Instagram Bring Strength To E-Commerce

For our team, the biggest impacts we’ve felt this year across Facebook and Instagram are the increased automation on the platforms, less advertiser control, and a lack of communication from Meta at-large regarding rollouts and product updates, especially in relation to their ad platforms.

In many ways, Meta has been a trailblazer for social media platforms; it’s hard not to notice the similarities between their ad platform and any other digital channel. The most significant difference we see as consumers are the AI differences between Meta platforms versus newer digital channels. The algorithms across Facebook and Instagram skew heavily towards shopping/E-commerce, which makes sense because more sales equal more revenue for Meta. But as Jon Loomer so eloquently put it, automation and optimization aren’t always good. Meta’s overall direction makes sense for e-commerce advertisers but has proven less effective when considering other industries and objectives. (SOURCE) We feel these impacts directly at Drake Cooper as most of our clients and efforts do not fall into the e-commerce landscape.

Who Will Win the Battle of Social Channels?

Earlier this year, I attended a webinar called Social Showdown: Facebook vs. TikTok. Over the past year, TikTok has accelerated its efforts to become the new 800-pound gorilla in the paid social ecosystem by improving the user and advertiser experience. But Facebook has made several changes to its experience as well. This webinar provided insights and updates around TikTok and Facebook’s advertising capabilities and how marketers expect more from paid social investments. (SOURCE) During that webinar, we looked at key metrics like usage on each platform, changes to come on the user and advertiser side, and success stories on each. Here’s where they landed:

TikTok will come out on top IF:

- Facebook fails to release new features to attract the younger demographic

- TikTok avoids privacy issues

- Facebook doesn’t update ad manager

- TikTok continues to empower advertisers of ALL stripes

Facebook will come out on top IF:

- Facebook succeeds in moving to an entertainment platform.

- Facebook avoids bad press and congressional hearings.

- Meta merges powerful toolsets (FB, Insta, Messenger, WhatsApp) to accelerate adoption – not just FB + Messenger (planned).

- TikTok makes bad bets.

Since this webinar took place there have been numerous changes to the social landscape. The future of TikTok in the US is in question as they work to come to an agreement with the CFIUS (Committee on Foreign Investment in the United States). And while we still see Meta’s social channels, namely Facebook, as important players we don’t see them ever returning to the dominance they once had.

Sources:

*CNBC, Meta Earnings Q3

*Bloomberg, Facebook Feed & New Types of Social Media

*TechCrunch, If You Think Instagram is Bad…

*Jon Loomer, Meta Automation

*Bloomberg, Meta Users

*Reveal Mobile, Social Showdown: Facebook vs. TikTok

What Rocked About Every Big Game Spot

Congratulations to all the agencies and their teams on making it through the gauntlet of the Super Sunday process. Here are some props for everything that rocks.

Our Creative Advertising Services

-

Corporate Positioning, Brand Evolution & Strategy

Mission/Vision Development, Strategic Counsel For Marketing/Branding Challenges

-

Market Research

Quantitative, Qualitative, Ethnography, Consumer and/or Internal Stakeholder Insights

-

Creative Campaigns

Brand Campaigns, Product Launches, Full Funnel Marketing Efforts

-

Brand Design

Brand Guides, Style Guides, Branding Elements, Logos

-

Web Development and Digital Applications

Open-Source Platforms, Enterprise WordPress, eCommerce, AR, Emerging Technology

-

Media Strategy, Planning & Buying

Media Planning, Media Plan Development, Media Buying, MMM, Online and Offline

-

MarTech

AI, Responsible Consumer Data Management, AdOps, Marketing Software

-

Analytics

Dashboards, Insights, Business Metrics Evaluation, ROI Reporting, Data Warehousing

-

Content Creation

Videography, Photography, Short-Form Video, Organic Social Content

-

Findability™

SEM, SEO, GEO (AI Generative Experience Optimization), Voice Search